How to Get a Tummy Tuck For Free?

Get a free tummy tuck surgery which will be covered by insurance for the weight loss. Many churches and Doctor offers free tummy tuck surgery to Poor Patients.

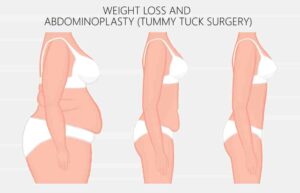

How to get a Tummy Tuck for free? Tummy tuck surgery or abdominoplasty is surgery for ladies who suffer from post-pregnancy fat and people who suffer from fat-related problems. In this process, the abdomen is thinner and excess fat is removed from the middle and lower abdomen. Tummy tuck for free has been a growing trend nowadays. A free tummy tuck is the most preferred option for people suffering from extra fat and fat-related problems. A few organizations help people get a tummy tuck for free which is not a free service normally.

However, specific sources offer financial assistance to those in need so they can get a tummy tuck for free. Apart from seeking help from organizations that offer free tummy tuck surgeries, you can also reach out to trainee surgeons who are still under training. This way, you would have a chance to negotiate with the surgeon and might even get the tummy tuck surgery for free. You can also look for the cheapest state for a tummy tuck. This could prove to be a delightful opportunity for those in need of surgery, providing them a solution when fundraising for the procedure might be challenging.

- Understanding the Inspiring Reasons People Choose Tummy Tucks.

- Sources to Get a Free Tummy Tuck

- How Can I Get A Tummy Tuck For Free?

- Free Tummy Tuck By Trainee Surgeons

- How To Get Free Tummy Tucks For Moms

- How to Get a Free Tummy Tuck Surgery?

- Can a Tummy Tuck be Covered in Insurance?

- Is Free Tummy Tuck For Skin Donation 2024 Valid?

- How To Get A Tummy Tuck Covered By Insurance?

- Conclusion

Understanding the Inspiring Reasons People Choose Tummy Tucks.

As mentioned earlier, a tummy tuck is majorly opted for by women struggling with their post-pregnancy bodies. Still, they are not the only demography group known to be going through with the procedure. Other people like those who are overweight and cannot lose the excess weight due to other reasons are also seen going to the surgeon for a tummy tuck.

Sometimes, due to a variety of circumstances, people may experience reduced skin elasticity and softer connective tissues in the abdominal area. This can inspire their appreciation for their bodies. Citizens with such issues are often seen looking for options to get a tummy tuck for free.

Free tummy tuck surgery is also viewed as a cosmetic surgery by many rather than a medically necessary one which was actually the point of introducing this kind of surgical procedure. However, this process removes the extra fat and skin from the stomach area. After that, the connective tissue is compressed, and the residual is tucked back in, in a way that it makes the area look more beautiful than it was before.

Not only does it enhance the beauty of that area, but it also tightens weak fascia. It also effectively removes stretch marks and excess skin and fat from the lower abdomen, which is a big concern for many. Tummy tuck for free plans have filled people with confidence and put them in positions of authority regarding their control over their bodies.

Sources to Get a Free Tummy Tuck

While abdominoplasty is often viewed as a premium procedure, unique opportunities could offer it as a complimentary service under certain circumstances. There are a few organizations that help people get a free tummy tuck.

You can go with them with your problem, and if they feel that you are eligible for their free tummy tuck program, you can get yourself a tummy tuck for free. Here are some ways one can get their tummy tuck for free.

National Health Service

The National Health Service is an esteemed organization committed to championing the health and wellness of the United Kingdom’s citizens. It stands as a beacon of support for those seeking medical assistance, including providing a free tummy tuck to eligible applicants. With the National Health Service backing the cost of a tummy tuck under specific conditions, it presents a unique opportunity for those seeking this transformative procedure.

While some additional procedures related to fat or skin removal following the main surgery may not be immediately accommodated due to the finite resources for such surgeries, the focus remains on delivering the primary, life-changing procedure. However, do not let this deter you. Aspiring recipients of to get a tummy tuck for free procedure need only to navigate the application process and patiently await their turn.

Understanding that not everyone is in a position to fund the procedure independently, the National Health Service opens the door to those who might not otherwise have access to such a beneficial operation. Alternatively, those without the means to pay for the surgery can apply for a free tummy tuck by trainee surgeons. This option helps maintain affordability and empowers the next generation of medical professionals through hands-on experience.

But those who can not afford to pay for this expensive luxury commodity can apply to the National Health Service for a free tummy tuck by trainee surgeons. If you want to go for the services provided by the organization, you first need to consult your daily practitioner. If he thinks you need to have a tummy tuck, he will refer you to a consultant who would then decide if you are eligible for getting funded by the organization for a free tummy tuck for skin donation 2024.

Must Read: Get Free Dentures For Low-income Families

Travel Abroad

You can travel abroad by getting yourself a tummy tuck for free. Some countries provide tummy tuck surgeries at affordable prices. Feel free to explore and discover locations offering complimentary tummy tucks for free.

Suppose you succeed in finding a place that provides free tummy tuck. In that case, you should check if it covers all the costs of the surgery, including the pre-surgery, surgery, and post-surgery. If these are covered, the next step will be checking the doctor’s eligibility.

It’s always important to thoroughly research and understand the qualifications of the professional conducting your procedure. You need to check if the doctor is a licensed person or not. Next comes the health conditions of the place you are getting operated at. You must check if the place is hygienic or not and whether it uses sterilized equipment or not. While going for surgery you may save up on surgery costs, but follow-up charges can cost you a lot sometimes.

Grants Help for Tummy tuck For Free

Grants for getting yourself a luxurious service like tummy tuck sounds unusual but is true and many people apply for it. Various organizations provide grants for a free tummy tuck. These grants for tummy tuck for free cover the cost of the surgery under the suggested practitioners’ surveillance and at a prescribed hospital. The amount granted for a tummy tuck for free is nearly $2000.

How Can I Get A Tummy Tuck For Free?

Getting your tummy tucked is not a big deal in today’s times. Many people prefer going for a tummy tuck surgery because of health issues, while others opt for it to get a better look at their body while they stand in front of the mirror and peer in.

Imagining all this is quite easy and lucrative, but one must know that getting the surgery done is not an easier task.

First and foremost, embracing all the guidelines suggested by your surgeon is essential, as is maintaining a certain fitness level to ensure the surgery is successful.

Some individuals might face the challenge of managing finances post-procedure, but it’s part of the journey toward enhanced well-being.

Many individuals who seek out this type of surgery may be navigating financial constraints, but their determination to pursue improved well-being is truly commendable. Hence, these programs offer a tummy tuck for free for such citizens. These programs that offer a tummy tuck for free and tummy tuck after c-section or tummy tucks for moms are titled after the universities where they are made available for those who direly need funds for the surgery or a tummy tuck for free.

University of Chicago Medicine

One of the largest organizations popularly known for their surgeries and financial assistance programs for surgeries for those in need, The University of Chicago Medicine has assisted several citizens with a tummy tuck for free.

Not only do they offer financial assistance to those who wish to get a tummy tuck surgery, but they also provide quality procedures. Performed by skilled surgeons with quality equipment, free tummy tuck surgeries carried on through this organization have a high success rate.

Often we fear that a tummy tuck surgery might cost a fortune, but the University of Chicago Medicine offers the surgery at a very affordable price. Along with affordable tummy tuck surgery plans, the organization also ensures you get financial assistance to get a free tummy tuck surgery if you have to.

The organization also conducts several other cosmetic surgeries. Hence, it is advisable to look at their official website and decide for yourself which is the best tummy tuck for free plan.

Penn Medicine

Penn Medicine which you might also recognize as Penn University is one of the best places you can reach out to for a tummy tuck surgery. If you have a proper plan ready for your tummy tuck and cannot choose where to go for this life-altering surgery, you can most certainly look out for available slots at Penn Medicine.

You may also get programs and plans through which the surgery is carried at quite an affordable price. These plans and programs have assisted numerous low-income, needy, poor, and less fortunate citizens.

You can get all the details regarding these plans and programs, including deadlines, eligibility criteria, areas in which they offer them, and application forms. You can have a look at these details and decide which free tummy tuck by trainee surgeons is best.

John Hopkins Medicine

John Hopkins Medicine is a healthcare facility that is ranked among the top 3 institutes that offer quality surgeries and that too, at an affordable price. The organization offers the best health care, as reviewed by several patients.

It has a wide variety of surgery options, such as tummy tuck after c-section and tummy tucks for moms after first childbirth. Still, they also provide medical students and world-class patient care post and pre-surgery patients a chance for research. You can find all these amazing details on their official website.

There you can not only do a quick research on how things work around the campus, but you can also book an appointment and look for a doctor who either is aware of your medical history or a doctor for some other issue that you might be facing, relevant and satisfactory health information regarding anything to everything.

So, if you are home-bound, you can still get medical assistance which feels just like a visit to the clinic right at your doorstep. The organization offers other benefits, but for that, you would have to spare a bit more of your time and explore their website thoroughly.

Free Tummy Tuck By Trainee Surgeons

As mentioned earlier, one of the answers to to get a tummy tuck for free is getting it done by a trainee surgeon. Trainee surgeons are required to learn the skills in the field, which is why they are required to perform surgeries under the supervision of an experienced surgeon.

Getting a free tummy tuck by trainee surgeons is one of the best ways to save money while getting what you wish. Some of the organizations that help with a free tummy tuck for moms and other individuals are mentioned above, but one organization that masters in-house or residence surgeries is UCLA.

UCLA is one of the most reputed educational organizations across the globe. Not only does it offer quality education, but also presents several opportunities for its students to explore and discover facilities that would benefit the world.

The UCLA Division of Plastic and Reconstructive Surgery is one of the most trusted faculties for offering state-of-the-art facilities and quality assistance. The organization has 145 surgeons under the roof who offer you the figure you wish through their skilled scalpel. Along with this group of skilled surgeons, UCLA also houses aspiring surgeons by offering them sub-specialty fellowships.

Currently, these sub-specialty fellowships are exclusively available to resident students, creating unique opportunities for them. Resident students are trainee surgeons as well. You can contact them to get a free tummy tuck by trainee surgeons.

To get a free tummy tuck from them, you might engage in a delightful exploration around the campus or kindly ask someone knowledgeable who could guide you towards these wonderful opportunities.. You can then talk to them about your issue, and if they agree, you have your free tummy tuck by trainee surgeons right in your sack!!!

Along with state-of-the-art facilities during the procedure, the organization ensures that the patient does not face any post-surgery complications.

To get a free tummy tuck by trainee surgeons by UCLA’s budding surgeons, one simply needs to complete an application and enroll in the program. On the bright side, there are certain documents that, when kept handy during your doctor’s visit, can streamline your healthcare experience. These documents include:

- A copy of your insurance card to verify your policy number, group, or certificate number.

- A photo ID.

- Usually, it applies to the patient. Still, you must check for the eligibility of Medicare or Medi-Cal cards, and if either of them is applicable, then you must carry them along on every visit of yours.

- A comprehensive list of your current medications, vitamins, and supplements will ensure a personalized and effective healthcare plan.

Before your first appointment, you must complete a New Patient Packet, which includes a Patient Demographics Form and a Medical History Form. Once you are done with all these procedures, your surgeon will direct you to further procedures, and ultimately, you will have your free tummy tuck by trainee surgeons.

How To Get Free Tummy Tucks For Moms

Post-pregnancy weight can be a tumult for many new mothers. They frequently view the natural changes in their bodies after childbirth, like the softness around their bellies, as part of the beautiful journey of motherhood. This is when many women opt for tummy tuck surgeries. One such similar surgery is the diastasis recti.

The diastasis recti is actually a condition where the abdominal muscle separates from the midline of the rectus abdominis muscle.

In simpler words, this condition can lead to a fuller-looking stomach after pregnancy. It’s common to hear mothers express concern about the naturally soft and stretched skin on their stomach post-birth. This is a natural result of the incredible process of childbirth.

Must Read: Government money for stay at home moms

Like a tummy tuck, this condition isn’t typically covered by insurance companies because it’s seen as an elective cosmetic procedure rather than a medical necessity. However, there are scenarios where it’s considered for coverage.

For example, a tummy tuck surgery could be considered necessary if the condition contributes to additional physical issues, such as backaches, hernias, or a slipped disc. Insurance might cover a tummy tuck in these particular circumstances.

To ensure the best possible outcome, it’s recommended that you consult both your doctor and insurance provider before proceeding. You will effectively utilize your time, energy, and resources.

How to Get a Free Tummy Tuck Surgery?

A tummy tuck surgery helps people get rid of their abdominal fat easily. While these surgeries can be an investment, the potential benefits and enhanced well-being they bring could be seen as priceless.

It would be a boon for people who could not afford this service to get a tummy tuck for free. There are a few ways to get yourself a free tummy tuck in general and a free tummy tuck after a c-section.

Loans for the surgery

You can get a loan to pay for the surgery. This way, you can get yourself a tummy tuck for free for time being. Then, later on, you can pay it back in lump sums according to your capacity. People who are eligible for these kinds of loans are those who are healthy and have maintained a stable weight. Those who have realistic expectations and are non-smokers are also eligible for the loans.

People who are considering weight loss in the future might wish to delay the surgery. This way, they can fully enjoy the results of their hard-earned efforts towards both weight loss and the surgery, without one affecting the other.

Also, women planning for future pregnancies may find it beneficial to postpone the surgery to ensure optimal results post-childbirth.

Approach Trainee Surgeons

Trainee Surgeons have been working under a practitioner for a while to gain experience. They are an affordable option to get your tummy tucked. Trainee surgeons may provide you with a tummy tuck for free. It depends on the surgeon you choose to go to. The risk of going to a trainee surgeon is undeniable, but if it can get you a free tummy tuck for skin donation Surgery, you might want to try it. Just as one needs to take precautions for getting it done abroad, one also needs to check various things when getting a tummy tuck for free from a trainee surgeon.

You need to check Doctor’s license, his history as to where he gained his experience, under which surgeon he worked before starting his practice, and the health conditions and hygiene levels of the place operate their patients. It’s beneficial to fully understand the specifics, terms, and conditions of getting a free tummy tuck from a trainee surgeon. This ensures clear expectations and minimizes any potential confusion in the future.

Read more: Apply Nursing Scholarships For Men

Get hampers

Many cosmetologists give discounts and vouchers to maintain their loyalty to the agency. These vouchers may sometimes consist of surgeries like these. A free tummy tuck might be offered to you if you remain a loyal customer of the agency.

This also works when you bring new customers for them and help them in the marketing of their products and services they have got to offer to people who suffer from any kind of dissatisfaction with their bodies.

One such firm is TRIA DESTINATION BEAUTY AND PLASTIC SURGERY CENTRE. It is a Bangkok-based firm providing tummy tuck for free if you participate in their competition.

To participate in the competition, you are invited to share a picture of your abdomen and a brief narrative about your journey with your body changes and why getting a tummy tuck would be a positive step for you. If found eligible, you might win the competition and get yourself a free tummy tuck surgery which costs almost $10,000 to $15,000 in the normal course.

Must Read: Get Scholarships for people with blue eyes

Can a Tummy Tuck be Covered in Insurance?

While tummy tucks are often seen as a luxury rather than a necessity, it doesn’t mean they’re entirely inaccessible.

Insurance coverage for tummy tuck surgery can vary. Although changes in policy in 2016 typically exclude abdominoplasty from coverage, there are still aspects of the post-surgery process that could be covered.

Medicare item number 30177, for instance, does provide coverage for certain plastic surgeries. To qualify for this, patients would need to meet certain criteria, creating a pathway toward the potential coverage of their procedure.

Eligibility:

- One of the qualifying factors is for the patient to have achieved a significant weight loss, reducing their BMI by five or more.

- A person must have lost at least 15 kgs without any changes for six months or more.

- Other important criteria include the degree to which the skin impacts daily activities.

- The non-medical methods to reduce fat should have failed to work.

- The patient has tried non-surgical methods for reducing fat, but those have not been successful.

If you are eligible, you can receive a rebate of $73.85. However, a consultation fee of $250 must be paid first.

Is Free Tummy Tuck For Skin Donation 2024 Valid?

Feeling light both at heart and weight while doing a good deed is rarely possible, but with a free tummy tuck for skin donation 2024 program, you can experience this joy!!!

Skin grafts are often used to treat burn patients. These grafts are created from skin that is donated typically after death. They serve as wound coverings to prevent loss of fluid and infection and are considered life-saving tissue transplants.

- Talk to your dermatologist about financing options

- Look into companies that specialize in medical financing

- Use a credit card to pay for your medical procedure

While there may have been rumors suggesting the possibility of free tummy tucks for skin donation under a purported program in 2024, it’s essential to note that no verified surgeons, hospitals, or organizations offer such a service. The integrity of information is key, so it’s vital to rely on factual and verified details when considering any medical procedure.

However, you can still do some good by donating the skin of your dead relatives. While it may initially seem like a delicate subject, cadaver donation is a standard and valuable practice within the field of cosmetology, contributing significantly to advancements in the field.

Cadaver donation is donating a dead body for the welfare of those in need. You must have heard of organ donation. People often donate liver, kidney, eyes, heart, and other organs of the body but we often forget the largest organ of our body.

While it may initially seem like a delicate subject, cadaver donation is a standard and valuable practice within the field of cosmetology, contributing significantly to advancements in the field.

One such surgery is grafting, in which skin from another area of the body covers one area affected by a burn or calamity. However, some patients lack skin that can be used elsewhere.

Instead of free tummy tuck for skin donation 2024 programs, you can look for a tummy tuck for free programs or how to get insurance to pay for a tummy tuck? Not only would these searches prove to be beneficial for your pocket but they might also lead you to grants that offer free tummy tuck.

How To Get Insurance To Pay For Tummy Tuck?

I already told you that getting insurance to pay for a tummy tuck is nearly impossible. But every plan, every program, every act has a loophole, and so does this!

Of course, through easier ways, you would not learn how to get insurance to pay for a tummy tuck, but if you try this method, you might learn to get a tummy tuck for free.

Before using this trick, it is important to understand the distinction between two surgeries: abdominoplasty and panniculectomy.

A panniculectomy is a procedure that is meant to remove excess skin, typically emerging from a significant weight loss, and is considered a medical procedure.

While on the other hand, a tummy tuck also includes the tightening of your stomach while enhancing and contouring your waistline.

This highlights the distinction between a tummy tuck as an aesthetic enhancement procedure and a panniculectomy is often undertaken for medical benefits and improved quality of life. Usually, a tummy tuck can cost you as much as $20,000.

Still, if you pass it off as medically necessary, a more significant part of your medical bill generated from the procedure can be eliminated.

Nonetheless, if your procedure is recognized as medically necessary, a substantial portion of your medical bill from the operation may be covered.

In order to be considered “medically necessary,” the terminology surrounding the procedure may need to be adjusted.

Of course, it’s not about endorsing insurance fraud but understanding insurance policies’ specific terms and conditions.

You would have to pay a little here, but that small amount can be easily managed. You can request your surgeon to break down the charges of both surgeries so that you do not have to pay a great sum of money but rather can get insurance to pay for the tummy tuck procedure.

This article is not suggesting any form of insurance fraud. Still, it aims to guide you on potential pathways to get a tummy tuck procedure covered by insurance or opportunities for complimentary tummy tucks.

Navigating how to have a tummy tuck covered by insurance can be complex and should be done ethically. This piece strives to address your concerns responsibly, guiding you toward possible options for a complimentary tummy tuck, whether trainee surgeons or experienced professionals perform it.

How To Get A Tummy Tuck Covered By Insurance?

We already know that a tummy tuck can be covered by insurance, but there are a few more ways you can learn how to get a tummy tuck covered by insurance. Now, these ways are not entirely different from the ones mentioned above, as they help you know to get a tummy tuck for free. But these ways can be kept as an alternative and put to use only if others do not come to your rescue. Read along to learn more about free tummy tuck procedures.

- Improve Your Well-being with Abdominoplasty

Excess weight or fat in the abdominal area can sometimes contribute to back discomfort. One can lessen issues of incontinence and backache with abdominoplasty.

Experiencing back pain is common among women during pregnancy and after childbirth.

However, it’s noteworthy that backache issues associated with weight can affect anyone, making it a shared human experience. Hence if you are suffering from such aches, you can consult your doctor and get your surgery done.

If your doctor deems a surgery necessary, it would confirm that excess weight or fat impacts your daily activities. This validation would then underscore the procedure’s medical necessity, emphasizing its role in improving your quality of life. With this proof, your insurer would have no option but to provide you with a handsome amount of coverage for the procedure.

This situation is slightly different, but if you have trouble walking properly, you can get a ventral hernia surgery, including a tummy tuck procedure. This way, you can get a tummy tuck covered by insurance and only have to pay minimal charges.

There are necessary documents that can validate your specific concerns, thus affirming the need for a procedure that could improve your well-being. The list of these documents can be accessed by the insurance company or an official working there who happens to handle your case. Once you submit all the details and documents to the satisfaction of the hospital, surgeon, and insurance company, the insurer will cover your medical bills, and you will get a free tummy tuck surgery.

Medicaid

Medicaid is one of the largest insurance providers in the United States of America. Several people depend on this insurance provider for payment of their medical bills and the smooth transition of their surgical and non-surgical procedures.

Given the magnitude of its responsibility to cover an entire nation’s healthcare needs, you can appreciate the rigorous eligibility criteria in place.

This underlines why such insurance plans may not include most elective or non-medically essential procedures. However, you can get a tummy tuck covered by insurance offered under Medicaid.

The trick or loophole here is to make it count as medically necessary. As said earlier, only medically necessary procedures and surgeries are covered by Medicaid or Medicare.

Therefore, if you’re hoping to get insurance to pay for a tummy tuck, it would be crucial to demonstrate its connection to a procedure that’s critical for your overall well-being. For instance, if your weight or fat hinders your daily activities or you are at a high risk of sustaining major health concerns, then you can get a tummy tuck covered by insurance offered through Medicaid.

Conclusion

A free tummy tuck has never gone out of trend since it was introduced in plastic surgery. It comforts people who are insecure about their bodies. Rather than going for a holistic approach, people prefer to go for such treatments that are quick and less painful. Tummy tucks for free are a blessing for people who wish to go for it but can not afford it due to their financial condition.

These free tummy tucks have not only helped beauty-conscious people, but it has helped people who were suffering from serious fat-related issues. These sources that help people eliminate their miseries have helped more than a million people until now. They provide the best care to those who come to them for a tummy tuck for free.

Frequently Asked Questions

Does insurance cover a tummy tuck?

Yes, Most insurance providers consider a tummy tuck surgery to be a cosmetic surgery done to enhance one’s bodily features. As a result, these insurance providers typically do not cover expenses related to tummy tuck surgery or abdominoplasty. However, you can get insurance for a tummy tuck procedure if your doctor considers it “medically necessary.” What medically necessary means can be explained to you by your doctor? Hence, you may consult your doctor before getting a tummy tuck covered by insurance.

Will insurance cover a tummy tuck?

Not all insurance companies offer coverage for a cosmetic surgery such as abdominoplasty or tummy tuck. You may consult your insurance provider or advisor and learn how to get a tummy tuck covered by insurance in a plan offered by your respective insurance company.

Suppose your advisor confirms that your current insurance doesn’t cover these procedures. In that case, you can consider the options we’ve previously discussed as potential paths to secure coverage for your tummy tuck surgery. Along with getting free tummy tucks after c-section or free tummy tucks in general that are covered by insurance, you can also look for organizations that will offer you the procedure free of cost.

Hi, My name is Tiffany Nelson and have been wanting a tummy tuck for decades. I’m 45 yrs of age and do to years of steroids to control asthma and two tummy tucks I have a hanging lopsided lower abdominal. If you want to know more about please contact me